Table of Contents

Introduction

- Importance of the Credit Report

- Application Requirements

Steps to Authorize the Consultation to the Credit Bureau

- Natural Person with Business Activity (PFAE)

- Legal Person (PM)

Conclusion

Introduction

Before starting, it is important to emphasize that this process is TOTALLY FREE for you. The consultation with the Credit Bureau will be paid for by Pymes Capital. The Special Credit Bureau is an entity in charge of collecting and managing the credit information of individuals. Obtaining a credit report can be crucial to understanding and improving your credit history. This manual will guide you through the process of requesting information from the Special Credit Bureau.

Importance of the Credit Report

Before requesting information, it is essential to understand why it is important to obtain a credit report. This document reflects your credit history, including loans, credit cards and other financial commitments. Lenders use this information when evaluating your creditworthiness, so it’s essential to review and correct any errors.

Application Requirements

Make sure you meet the necessary requirements before starting the application process. Typically, you will need to provide personal information and identification documents, such as your full name, address, identification number, and proof of address.

Steps to Authorize the Consultation to the Credit Bureau

Depending on whether you are a Natural Person with Business Activity (PFAE) or a Legal Person (PM), these are the necessary steps to authorize Pymes Capital to consult your online Credit Bureau. If a Moral Person is going to be authorized to consult the Credit Bureau, it is necessary that the main shareholders and the legal representative also authorize the consultation of their Credit Bureau:

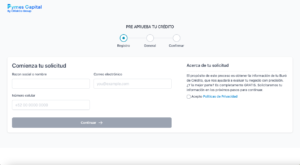

NATURAL PERSON WITH BUSINESS ACTIVITY (PFAE)

- Enter the website: https://pymes-capital-inc.moffin.co/solicitud/mca-pfae/comenzar.

2. The following screen will appear:

3. Once you complete this information and press the I accept the privacy policies button, press “Continue”. The system will send you a registration code to your cell phone and then send you to the next tab.

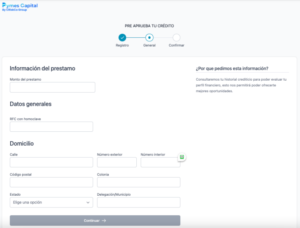

4. Once the registration code has been entered, press “Validate PIN” to go to the following screen:

In the “Loan Amount” field, write the amount of financing requested.

5. Once the requested data has been entered, press “Continue” to go to the next screen:

6. Authorization finalized:

Once you have submitted your application, stay informed about its status. You can follow up by phone or email, directly at Pymes Capital.

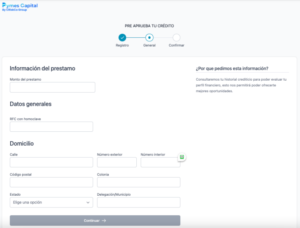

LEGAL PERSON (PM)

1. Enter the website: https://pymes-capital-inc.moffin.co/solicitud/mca-pm/comenzar.

2. The following screen will appear:

3. Once you complete this information and press the I accept the privacy policies button, press “Continue”. The system will send you a registration code to your cell phone and then send you to the following tab:

4. Once the registration code has been entered, press “Validate PIN” to go to the following screen:

In the “Loan Amount” field, write the amount of financing requested.

5. Once the requested data has been entered, press “Continue” to go to the next screen:

6. Authorization finalized:

Once you have submitted your application, stay informed about its status. You can follow up by phone or email, directly at Pymes Capital.

Conclusion

Obtaining your credit report is a crucial step in taking control of your financial situation. Be sure to carefully review the information provided in the report and take steps to correct any errors. Stay on top of your credit history to build and maintain good financial health.

If you have any questions, please do not hesitate to contact us.